Roy Saadon, CEO, AccessFintech

Sponsored by AccessFintech

The cyclical demand for improvement, automation and cost reduction is ever present, especially in our dynamic financial markets. Efficiency wins are harder to find and quickly replaced by the expectation of further improvements. We always seem to be caught in a pincer movement of rising costs (new regulatory mandating reporting, capital requirements) and top line pressures (macro challenges of low interest rates), driving the industry to take a long, hard look at its cost to income ratios. At the same time, our industry has been incredibly adaptive and responsive, lately using the catalyst of FinTech driving innovation and opening the industry’s eyes to what is possible with the current and future technology.

Firms often target what they have independent control over – internal inefficiency. Whether it is relocation of workforce or addressing a history of M&A and legacy technology that contributed to a myriad of disparate, sometimes unrelated systems and technology in place can place enormous pressures on the way they conduct their business.

As we search for the yet untapped next big play, focus has been turning towards the fragmented supply chain – processes between banks and counterparty banks, clients and other players in the transaction lifecycle that are harder to change but hold massive gains.

As McKinsey has discussed, financial institutions need to pull at multiple levers to maximise productivity and cost impact. They need to apply transformation across operations in a systematic way.

How AccessFintech has responded?

During the beginnings of our company, our value proposition was a simple, very focused concept –resolving trade exceptions. That undoubtedly created value by cutting down inefficiencies and automating manual processes.

But AccessFintech was always about something more than just fails cost reduction. We knew that productivity gains on a much larger scale were locked up in the entire ecosystem and “different thinking” was needed to tap them. Over time, our vision crystallised. The bigger idea at the heart of our company is about true collaboration, which unlocks much greater value for the whole operations ecosystem. We realised that tremendous benefits are there within firm’s touching distance – but they can only be achieved if firms take that improvement step together, coordinated and in collaboration.

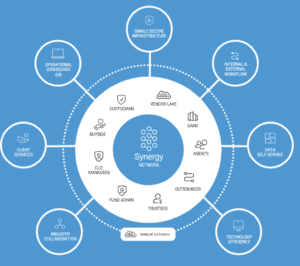

We’ve come to encapsulate that concept in the word ‘synergy’ – the AccessFintech Synergy Network. Put simply, it’s the way AccessFintech provides a modern and secure collaboration network that facilitates three key capabilities: data collaboration at scale, workflow optimisation and technology distribution.

It aims to release massive, locked value that firms cannot individually achieve. Synergy is the ‘network’ of data workflow and technology. The word Synergy captures everything that we do – it is a synthesis, it is about collaboration, and the partnership that we have with the market.

Better through aggregation and enrichmentFirms working together have started creating more valuable transaction data. They have molded single-firm transaction data into cross organisation transaction lineage. The Synergy Network presented a view on transactions that was not there before – aggregating isolated data points, subjective opinion, from multiple parties. Working together creates more valuable transaction data, which enables workflow across multiple firms, and workforces are optimised through digital automation, resolution and having decision-making in one place.

Better data drives better workflow

Better data drives better workflowThe superior data enables firms to work together, to identify places of efficiency. We need to move from the goal of fixing problems faster, to predicting eliminating problems altogether. Synergy enables clear ownership of tasks across firms, reducing wasted duplicative efforts.

Shared data access enables tech adoptionMany of the changes financial institutions are eager to achieve involve getting new tech (FinTech) solutions access to legacy data. Now that legacy data has been cleaned, enriched, and placed on a purpose-built data sharing platform – the challenge of tech innovation has become a much different proposition. It has moved from high risk/ high effort, to low risk/fail fast approach.

Creating value for our clients where a single organisation cannot do it by itself is the aim. The reality of financial institutions is that they have dependency on multiple firms’ data for decision making, multiple firms’ operations to take action, dependency on clients’ choices. They must decide which technology to use and how quickly.

We understand that the Synergy Network is about removing friction and limitation of a single firm, to be able to work on data, workflow, and shared tech – with other firms. The friction is the four walls a single firm must break out of to achieve those hidden benefits.

Releasing value for financial institutions

Financial institutions encounter repeat problems that lock up huge amounts of value. If they can, instead create a ‘synergy’ between the firms they work with – on data, on workforce and on technology – there is a huge amount value to be extracted.

When we thought about the three pillars of data, collaboration and technology, the problems we can resolve are not limited to specific use cases. If we accept the fundamental statement that collaboration unlocks efficiencies, then the significant journey is to travel through the organisation uncover as many of those places where you can release value.

We started with one use case which was settlements, then payments, regulation, additional assets such as loans, but there is a continuous appetite to do more. While uncovering those places, we can also see our value across new industries.

The ability to move very easily into new use cases, critically, without having to create and build new code, is the power of what we have built, and what the market needs now.

The true value of AccessFintech is in transforming the way capital markets operations are conducted by providing the venue where transformational collaboration and data-sharing occurs.

In a period of unprecedented demand across the financial ecosystem, clients need to address their operational inefficiencies, and find solutions to challenge how they can be positioned to keep up with the ever-increasing pace of innovative change.