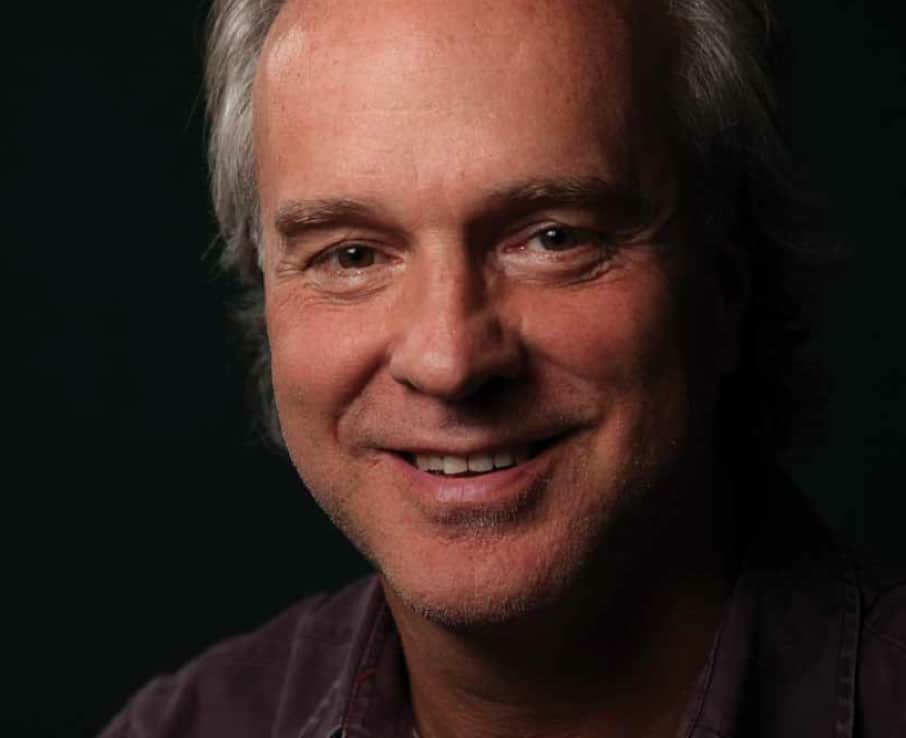

Former Head • Asian sub-custody network • HSBC

Nick Bryan knew he wanted to live in Hong Kong from the moment he first visited the island at the age of 12 in 1967. The man who placed him there was his father, who had taken a job flying planes for Cathay Pacific after leaving the Royal Air Force (RAF) earlier that year. For the next 6 years holidays from his boarding school in England were passed in Hong Kong, where the young Nick Bryan developed a passion for sailing that clients, colleagues, friends and family have underestimated at their peril. But Nick Bryan did not actually get to live and work in Hong Kong for another 17 years, when HSBC finally posted him to the then Crown Colony for spells in trade finance and credit. “I can still remember the first time I touched down at the old Kai Tak Airport, and the buzz I felt, as I finally landed in Hong Kong to actually live and work,” recalls Bryan. “I not only got to watch the very impressive Norman Foster HQ being built, but reached the halfway mark in my career with the bank. It was time to see if I could move up to and survive in ‘senior management.'” As it happens, his first attempt at upward mobility was not in custody, but credit cards. Between 1988 and 1990 he launched credit card businesses for HSBC throughout the region, starting in Taiwan and culminating in India, which Bryan remains convinced will one day rival China as the biggest card market served by the bank. But it was on Jan. 1, 1991, that Nick Bryan finally joined the business that truly made his reputation, when he became head of sales for the then nascent Asia Pacific custodian services network of HSBC.

Nick Bryan knew he wanted to live in Hong Kong from the moment he first visited the island at the age of 12 in 1967. The man who placed him there was his father, who had taken a job flying planes for Cathay Pacific after leaving the Royal Air Force (RAF) earlier that year. For the next 6 years holidays from his boarding school in England were passed in Hong Kong, where the young Nick Bryan developed a passion for sailing that clients, colleagues, friends and family have underestimated at their peril. But Nick Bryan did not actually get to live and work in Hong Kong for another 17 years, when HSBC finally posted him to the then Crown Colony for spells in trade finance and credit. “I can still remember the first time I touched down at the old Kai Tak Airport, and the buzz I felt, as I finally landed in Hong Kong to actually live and work,” recalls Bryan. “I not only got to watch the very impressive Norman Foster HQ being built, but reached the halfway mark in my career with the bank. It was time to see if I could move up to and survive in ‘senior management.'” As it happens, his first attempt at upward mobility was not in custody, but credit cards. Between 1988 and 1990 he launched credit card businesses for HSBC throughout the region, starting in Taiwan and culminating in India, which Bryan remains convinced will one day rival China as the biggest card market served by the bank. But it was on Jan. 1, 1991, that Nick Bryan finally joined the business that truly made his reputation, when he became head of sales for the then nascent Asia Pacific custodian services network of HSBC.

At the time, it felt like merely the latest in a series of 2-3-year stints in different parts of the HSBC business empire. After all, Bryan was not merely an international gypsy by family background and personal temperament. He was from the outset of his career at HSBC one of the so-called “red berets,” the group of internationally minded managers who are prepared, in his own words, to “go anywhere, at any time, and do anything.” Those who have served with the International Managers (IMs) group, as they are officially titled, see it as a major differentiator between HSBC and every other international bank. Certainly, the IMs are an elite group, whose number never exceeds 350 out of total bank payroll of 350,000 people. Yet almost every member of the senior management of the bank worldwide has served with the program at some stage-and Bryan makes no secret of his pride in being part of it throughout his career with HSBC. “You typically serve only 2-3 years in any posting,” he explains. “People are expected to go to a new country to do a new job on a rotational basis, so the team has a very wide exposure to the bank, in different continents with different products. Because they are always moving to a new job, they are uniquely positioned to transfer best practice and corporate ethics between any two countries.”

This is not easy. It means leaving homes and friends behind every 24-36 months, but the red berets make up a truly global banking team. Because his father was in the RAF, and moved between air force bases around the world at least every 2 years, Bryan adjusted early to a life of constant movement. A 5-year stint at a British boarding school on the South Downs, with the nearest female company at least eight miles away in Brighton, also prepared him for certain privations. But being internationally mobile has its benefits. Bryan notes that, as a result of his service with the red berets, he has direct personal contact with the HSBC chief executive in every country (80) where the bank has an operation. The value of that personal contact, when it comes to cross-selling or getting something done for a customer, is too obvious to state. It also helped grow the HSBC custodial network in the 1990s. When he chose to open sub-custody operations in the Middle East in the mid-1990s, Bryan knew exactly what he was doing. His first stint overseas of any kind for HSBC was to Doha (a 2-month training course in 1976) and his first posting was to Oman (branch manager, 1977-79). “Having joined HSBC to take on the world, ending up in Salalah, described by Wilfred Thesiger as ‘a smelly little fishing village,’ was not what I had in mind,” recalls Bryan. “Still, it was better than Doha, where the heat was intense, everything was the color of a sandstorm, and my rented accommodation included a plastic sofa and a large number of rats.” Subsequently, Bryan has been back to visit both, Oman in particular, where he is now trying to write business.

But it was in Doha, Salalah and Abu Dhabi (where he was branch manager, 1979-81) that Bryan learned about banking in emerging markets. His responsibilities included the only one-man branch in the entire HSBC group, a compass direction as a postal address, cash deliveries to oil rigs by helicopter, and branches on both Das island (which he likens to the offshore penitentiary in Papillon) and Jebel Dhanna (“where David Beckham has not bought a pad”). But his personal favorite among the branches he ran was a Nissen hut on the British air force base at Thumrait, Salalah, used by the British servicemen then battling the marauding Yemenis to remit alimony payments to their estranged wives back home. The Middle East nevertheless has happy memories for Bryan-he met his wife Traudy on the same extended Omani beach as his own parents had met in the 1950s, when his father served with the RAF in Aden-but the same cannot be said of what followed. The Philippines, says Bryan, was a crash course in real life. From 1981-84 he worked in Manila, investigating and resolving problems in the Philippines branch network. The country was then at the nadir of its fortunes, following the misrule of Ferdinand Marcos. “The working week was very tough, and very demanding,” recalls Bryan. “People were not getting paid, let alone forgoing pay rises, at a time when inflation was rampant, and the country was politically unstable. I was even attacked in my own car. The offset to that is that the Philippines is a picturesque country with wonderful people.”

Wonderful people or not, it is scarcely surprising that he was glad to leave for Hong Kong, even for those less-than-glamorous years in training, trade finance and credit. After gaining expertise in opening new credit card markets and aggressively growing the business to become “market leader in class,” the invitation to head sales for HSBC Custodian Services proved serendipitous. His arrival in the custody industry coincided with the discovery of the Asian Tiger economies by American and European fund managers. At the time, HSBC was offering a sub-custody service in Hong Kong, Indonesia, Malaysia, the Philippines, Singapore and Thailand, but it bore little relation to the sophisticated combination of local servicing operations and specialist processing centers of today.

Safe custody had simply evolved from the safe deposit services offered as part of normal commercial banking, natural enough in predominantly paper-based markets where local investors needed somewhere safe to keep their stock and bond certificates. “All the Asian markets were all certificate-based at that time, so there were vast amounts of paper in the system,” recalls Bryan. “Custody was really about keeping track of share certificates per account, and per client, and making sure they were in a safe deposit box.” If the markets look different today, it is not only because they have dematerialized. Since 1991 they have slowly opened up to inbound investment, obliging HSBC to transform a primarily domestic safekeeping service into an international clearing, settlement and asset-servicing franchise spanning 40 markets in three continents.

Bryan was the chief architect of that massive and rapid expansion over the next decade and a half, especially after he became global head of sub-custodian services in 1997. It is testimony to his extraordinary capacity to persuade his superiors to give him resources and responsibility that this meant he was leading the only global product run exclusively out of Hong Kong. Ordinarily, of course, the IM program would long since have carried him off to new challenges in another part of the world, but he became entrenched for the best of reasons and the worst of reasons: There was no obvious person to take his place. HSBC first tried to move Bryan on in 1994, but the management soon recognized that he and the market-leading team he led were essential to the maintenance and growth of a new and rapidly expanding business that ran into the same challenges and obstacles again and again. “Trade finance, for example, is such a core business of HSBC that virtually all senior management in the bank, up to and including the chairman, would have had a spell in it and be familiar with all the issues,” says Bryan. “The custody service was a new product in new countries, started from scratch, so understanding how to transplant the capability to new countries, and provide a first-class service irrespective of the breadth and depth of experience in each market, was not widespread within the bank. Our ability to do that was a major competitive differentiator.” But if he had lost the mobility that comes with being a red beret, Bryan was scarcely a stay-at-home manager. Throughout his 17 years in the sub-custody business, Nick Bryan and team opened a new market every 6 months. His travel schedule was punishing.

“In fact, I spent a third of my life on a plane,” says Bryan. “That allowed me to spend enough time in the markets that required my presence, either to research a service or launch a service, or build relationships in the local market. It also enabled me to spend a third of my time in clients’ offices, hearing it from the horses, as it were, and a third of my time in Hong Kong building the capacity and exporting it to the new markets.” Of course, the expansion of the HSBC sub-custody and clearing network owed much to the globalization of investment as well, and Bryan is the first to acknowledge this. “It was a case of right place, right time,” he explains. The timing was certainly sweet. The early 1990s saw a flood of money into emerging markets, and Asia was a prime beneficiary. The custody business had to grow fast, effectively learning on the job. If Hong Kong and Singapore were relatively mature securities markets, even in 1991, markets elsewhere in the region had remained predominantly domestic. Many were closed all together to the outside world until the liberalizing measures of the 1990s. The gradual opening to foreign investors of Asian markets such as India, Korea, Taiwan and China-initially through the B share markets, and latterly via the Qualified Foreign Institutional Investor (QFII) and Qualified Domestic Institutional Investor (QDII) schemes-created an appetite for local custody services that HSBC was well placed to fill.

The nick Bryan business philosophy

1. Absolute integrity must become a byword

2. Passion in whatever you do helps make the difference between winners and losers

3. Extreme and relentless customer service is imperative, 24x7x365

4. Exercise “perfect practice makes perfect” in all of your business pursuits

5. Always look for ways to create a new “edge” in whatever business model you have

6. Staff really are the most critical commodity-invest in them, nurture them, play with them and listen to them; they will reward you in buckets

7. Even the small people count: No person is too small to matter. Rather, by showing empathy and recognition to the small, you will automatically know how to handle the big

8. Always try and end the working week with a “glass of milk” with your team-it helps create the “winning team”

9. Learn, teach and create

10. Always go home-there will be smiling faces waiting to provide you with a harbor in any weather

By the time he retired in November 2008-the rules of the “red berets” include retirement at 53-Nick Bryan and his team had grown the assets under custody across the network from $100 million to over $2 trillion, launched fund administration in Asia and the Middle East, and developed corporate trust services in Hong Kong, London and New York. But nothing illustrates more vividly just how explosive and demanding this growth was than India. When HSBC opened in Mumbai in 1993, Bryan and his colleagues forecast an inflow of $1 million of foreign investment into the market, which the bank would typically share equally with Citi and Standard Chartered. As it turned out, foreign investment not only flowed into India at three times the anticipated rate, but also gravitated toward HSBC as the safest option in the wake of the infamous Harshad Mehta stock market trading scandal of 1992. “Instead of a 30% market share, we ended up with 70%,” recalls Bryan. “To cope with this flood of business, in a market where we were dealing with tens of thousands of share certificates and payment by check, we had to increase our staff from 30 to 300 in the space of just 3 months. The vaults of the bank filled with paper so quickly that we ended up looking at gymnasiums, basketball courts, warehouses and even cinemas to store the vast flows of paper.”

Today, Bryan refers to the Indian start-up as “the university of how-to-do-it.” Graduating from such a demanding school certainly equipped him with a more-than-useful illustration when the Chinese market authorities asked custodian bankers for views on whether it made sense to retain paper certificates or dematerialize when opening the B share market to foreign investors. Bryan wisely insisted on basing his own Chinese sub-custody operations in the mainland cities of Shenzhen and Shanghai, where B shares were traded. It gave HSBC an edge over competitors who remained in Hong Kong, on the grounds that clients needed the SWIFT connectivity that was then unavailable in Mainland China. “We made clever use of Hexagon, our proprietary system, to convert a SWIFT message into a local message, and back again,” explains Bryan. “That put us on the mainland 10 years before our competitors did the same thing.” Today, HSBC remains the market leader in China.

But if China was a triumph, Japan was in many ways an even greater one. With the less-than-wholehearted support of the Asia-Pacific CEO (“I disagree with your business decision, but I am not going to bet against it-your move”), Bryan took HSBC into Japan on the belief that network managers concerned about the credit risk of the domestic Japanese banks would welcome a well-capitalized foreign alternative. His hunch was soon vindicated. Between 1997 and 2003 HSBC enjoyed spectacular success in winning sub-custody mandates in Tokyo. That was real dragon-slaying. Despite the self-inflicted wounds of the indigenous banks, Japan was then and is now easily the most daunting market of any in the world for a foreign bank to penetrate. Today, it remains the only market of any size where standalone domestic custodians have retained a substantial market share. Flushed with that undoubted triumph, Bryan then switched his focus to Australasia. Start-ups in Australia and New Zealand were successful enough to make HSBC the obvious buyer of the Westpac sub-custody business in 2006, although it was ten times the size of its own franchise. “In expanding throughout the region, our aim was to offer a pan-Asia Pacific one-stop shop,” explains Bryan. “The rate of growth was determined to some extent by exactly when a market opened to cross-border investors, and when we could satisfy ourselves that we could offer a service of at least equivalent quality to that we offered elsewhere.”

That consistency in terms of service quality was essential as HSBC sought to work with existing clients in new markets, and transform the offering from a collection of domestic services into a genuinely multi-market service. Once it was in place throughout Asia, clients liked it enough to encourage Bryan to repeat the trick elsewhere. He turned first to the Middle East, where HSBC opened sub-custody operations in ten markets in rapid succession, grabbing an effective monopoly that competitors have only recently dared to challenge. Next came the three main Latin American markets of Argentina, Brazil and Mexico, which account for three quarters of investment flows to the continent, and where the sub-custody business was then owned by a combination of Bank Boston and Citi. Bryan reasoned that HSBC could compete. It had branches in place, the stock markets were sizeable and there was palpable interest from existing clients, who were already impressed by the consistent standard of service in the Asian and Middle Eastern markets. In fact, by extricating the J.P. Morgan account over 6 months, HSBC started in Brazil with a 30% market share. Bryan also explored central Asia, opening an operation in Kazakhstan in 1998. The research for the Almati operation provided him with one of the few genuinely disconcerting experiences he had in 17 years of travel on behalf of the HSBC custody network, when a trip to the airport with several heavily armed men felt more like a state-sanctioned kidnap than a reassuring escort provided by the intelligence services.

Being aware of your surroundings is of course exactly what is expected of the red berets, but intelligent risk-taking (as opposed to recklessness) is what marks Nick Bryan out from the usual run of commercial adventurers. The fact Bryan chose to lodge at the Barbican YMCA when he first joined HSBC in London way back in 1974, for example, may read oddly now, but made perfect sense to a young man fresh out of school, with little money and an understandably cautious approach to life in the dangerous capital of a decaying country. Besides, the YMCA had some obvious attractions: It was near the HSBC offices on Gracechurch Street, and provided a bed, showers, heat and light, and two hot meals a day. It was during this time that Bryan honed his formidable table tennis skills, ping pong being a more affordable option than the pub. Not that Bryan is one to underestimate what he calls “a glass of milk.” Indeed, he knows and cares enough about bars to own several in Hong Kong-one of them the venue of the Global Custodian 20th anniversary party at Sibos last year-and declares authoritatively that the best bar in the world is to be found in Buenos Aires. Indeed, although Bryan is apt to dismiss his Hong Kong bar and restaurant business in the trendy Soho district of his favorite city as “a hobby that got out of control,” the neutral observer detects another important facet of the Bryan personality at work. Nick Bryan is a sportsman, and not an ordinary one either. He has run for Sussex, swam for Malaysia, played rugby for Qatar, Oman, Abu Dhabi and the Philippines, won or competed in national sailing competitions in Oman, the Philippines and Hong Kong, and in 1988 became an Olympian, sailing the single-handed Finn class for Hong Kong at the Seoul Olympics of that year.

If Seoul was the pinnacle of his active sporting career, it is obvious that Nick Bryan not only continues to love sport-his first move after retiring (or “rewiring,” as he prefers to call the next phase)-was to take and pass his Marine license examinations, but has applied its disciplines with success in his business career. The five-strong Staunton’s Group of bars and restaurants is a clear instance of the sportsman at work in another sphere. Bryan is simply determined to find out if he can be as good at a business with 10,000 competitors in Hong Kong alone, without the assistance of one of the biggest brands in the world behind him. Though he is not completely averse to the synergies between the two sides of his business career, particularly in terms of product selection, market positioning, pricing and client service, Bryan prefers another explanation for his catering investments. “If you are going to spend money in them anyway, why not pay yourself a dividend at the same time?” he asks. “There are three things in life people really care about. Eating, making money and making love. I have spent my career in two of those, and have no intention of advising on the third.” But he is prepared to share his business philosophy (see “The Nick Bryan business philosophy”) and it is no surprise to find that at least half of his ten points would not be out of place on a sports field. It is more than significant that, in his sporting career, Bryan always looked to take responsibility. He wanted to be the captain of any team he was on. This characteristic was evident eerily early on. As a cub scout in Malaysia in the early 1960s-his father was seconded to the Royal Malaysian Air Force from 1963-66-Bryan chose to be sixer in the (second-best) yellow six over seconder in the (best) red six. “I said to myself, ‘Do you want to be leader of the worst, or second-in-charge of the best?'” recalls Bryan. “I chose the yellow, and within a year we had knocked the reds off their perch.”

Now retired from HSBC for a few weeks short of 2 years, and several months beyond a 12-month consultancy contract with the bank to boot, Bryan is still looking to knock competitors of their perches. “During what became an interesting ‘self assessment year,’ the three things that struck me were, one, most of my friends and business connections were likely to be locked in employment for at least another 10 years; two, I found it important to keep my hand, and more specifically my head, involved in the mechanics of business; and three, having finally gained some work-life balance for the first time in memory, that I had to make sure to preserve this,” says Bryan, but the last part of this is manifestly nonsense. He has already invested in a chain of convenience stores in New Zealand and added two outlets to the Staunton’s Group. He has also signed up with a private equity group, LJ Capital, spanning his favorite continents “PAMELA” (Pan Asia, Middle East and Latin America). Not surprisingly, he also remains well-connected to the securities industry. Certainly, Bryan is not short of offers of work but, as even his career at HSBC demonstrates, he is at bottom an entrepreneur rather than a corporate man. As age and the demands of work and family curtailed his sporting activities, Bryan channeled his energies into business in ways that were imperceptible even to him. As it happens, that is exactly what the HSBC recruitment managers that hired the young Nick Bryan in 1974 expected to happen. Bryan recalls how puzzled he was that they were more interested in his prowess at rugby football than his academic qualifications, but now he sees what they saw.

“In retrospect, it was a sensible skill to focus on,” he says. “The skill set required for a rugby team to win consistently is not that far removed from the skill set required for a business team to win consistently. Rugby is a team sport. There are a lot of people on the pitch. You also have to throw the ball backwards, and whether you throw the ball over your left shoulder or your right, in a ‘winning team’ [his favorite mantra] there is always someone there to catch it. Metaphorically speaking, the ability to throw the ball … left or right and know you will automatically be supported, because people understand how to play the game, is a great strength in business.” The sailing helped too. Certainly, the high degree of consistency the HSBC sub-custody and clearing network developed under the leadership of Nick Bryan must owe something to the lesson he absorbed from a day spent with the Australian America’s Cup Legend John Bertrand: “Perfect practice makes perfect.” The determination Bryan brought to besting the competition in the annual Global Custodian agent bank survey was a mere echo of the ambition that took him to an Olympic start-line, but it had its source in the natural competitiveness of the sporting man. Bryan even used a rugby term (“the Triple Crown”) when referring to his goal of getting the best score, winning a top rating and coming first in every market in the survey. That HSBC has found it harder to win the Triple Crown since Nick Bryan retired is more than coincidence. Try as his successors might, clients miss what Bryan calls “extreme and relentless customer service.” Clients that found themselves yacht racing around San Francisco Bay (Sibos 2000) and especially Sydney Harbor (Sibos 2006), where strong winds and rain reduced racing yachts to a single sail on a 45-degree angle, learned exactly what “extreme” and “relentless” mean to Nick Bryan. After all, anyone who took corporate entertainment that seriously is exactly the sort of person you want looking after your assets in custody.

Not surprisingly, Nick remains based in Hong Kong, “the 240 volt city,” and is always standing by at Staunton’s, Soho, ready to talk about new, or reminisce over old, with all global friends who pass through. –DSH